tax deferred exchange definition

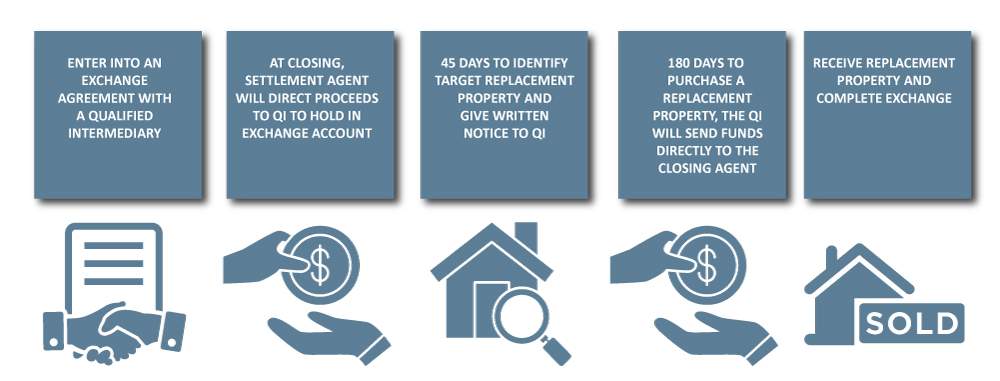

After the relinquished property closes the exchanger has 45 days. 1031 Tax Deferred Exchanges allow you to keep 100 of your money equity working for you instead of paying losing about one-third 13 of your gain or profit toward the payment of your capital gain and depreciation recapture taxes.

Irc 1031 Exchange 2021 Https Www Serightesc Com

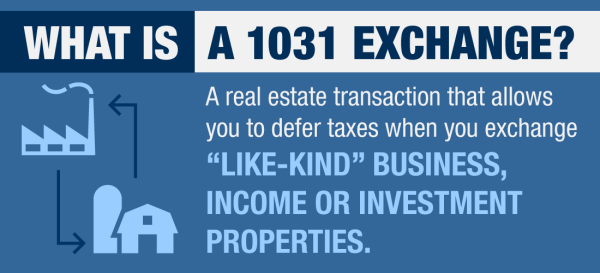

Specifically the tax code referring to 1031 Exchanges in IRC Section 11031 reads No gain or loss shall be recognized on the exchange of real property.

. This means for the purposes of condemned property the replacement property will be deemed to be like-kind and the requirements met so long as both the condemned and the replacement. However by using the process of a 1031 Tax Deferred Exchange a property seller can shift their funds from the sold property to a new purchase or purchases. Enter the 1031 Tax Deferred Exchange.

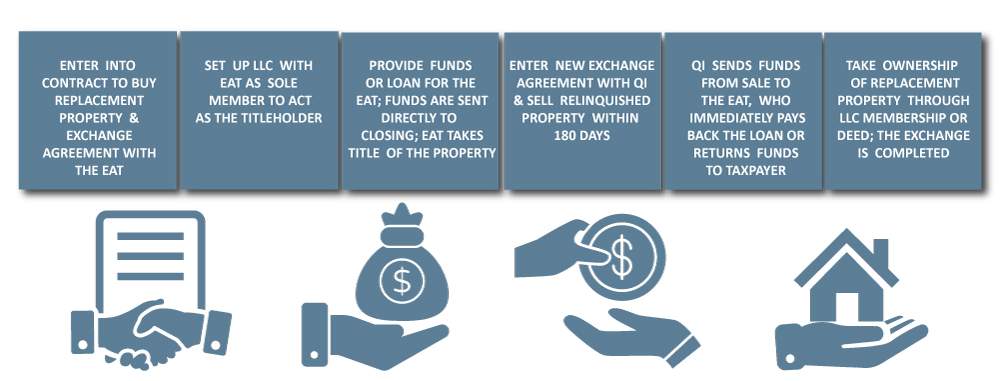

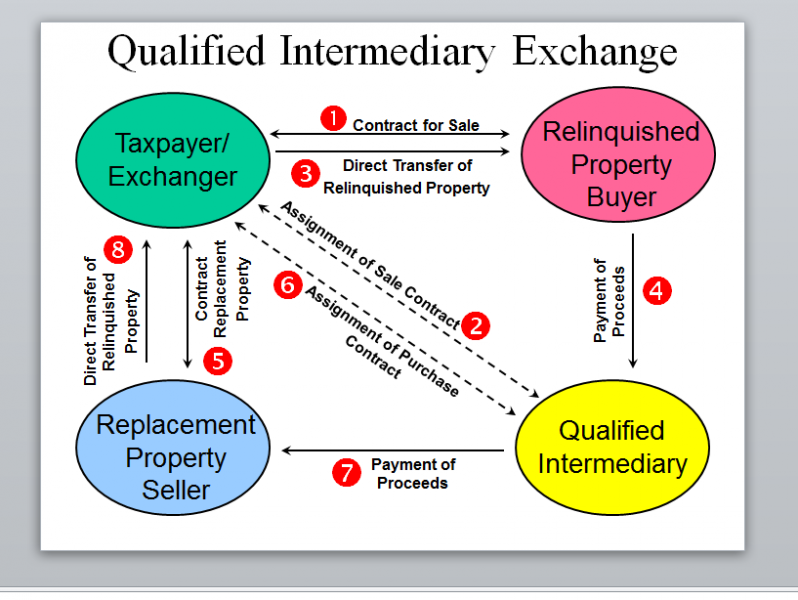

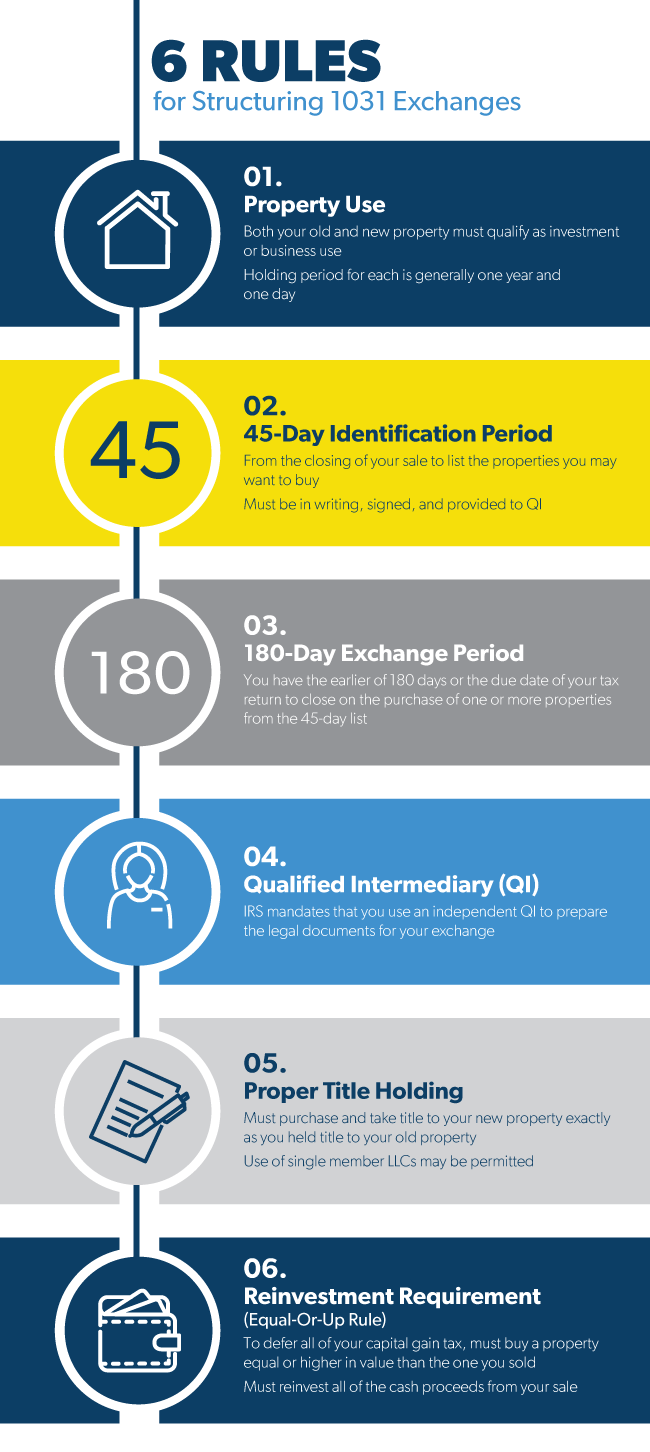

The Reverse Exchange is structured primarily with Revenue Procedure 2000-37 in mind. The 1031 tax-deferred exchange is a method of temporarily avoiding capital gains taxes on the sale of an investment or business property. By completing an exchange the Taxpayer Exchanger can dispose of investment or business-use assets acquire Replacement Property and defer the tax that would ordinarily be due upon.

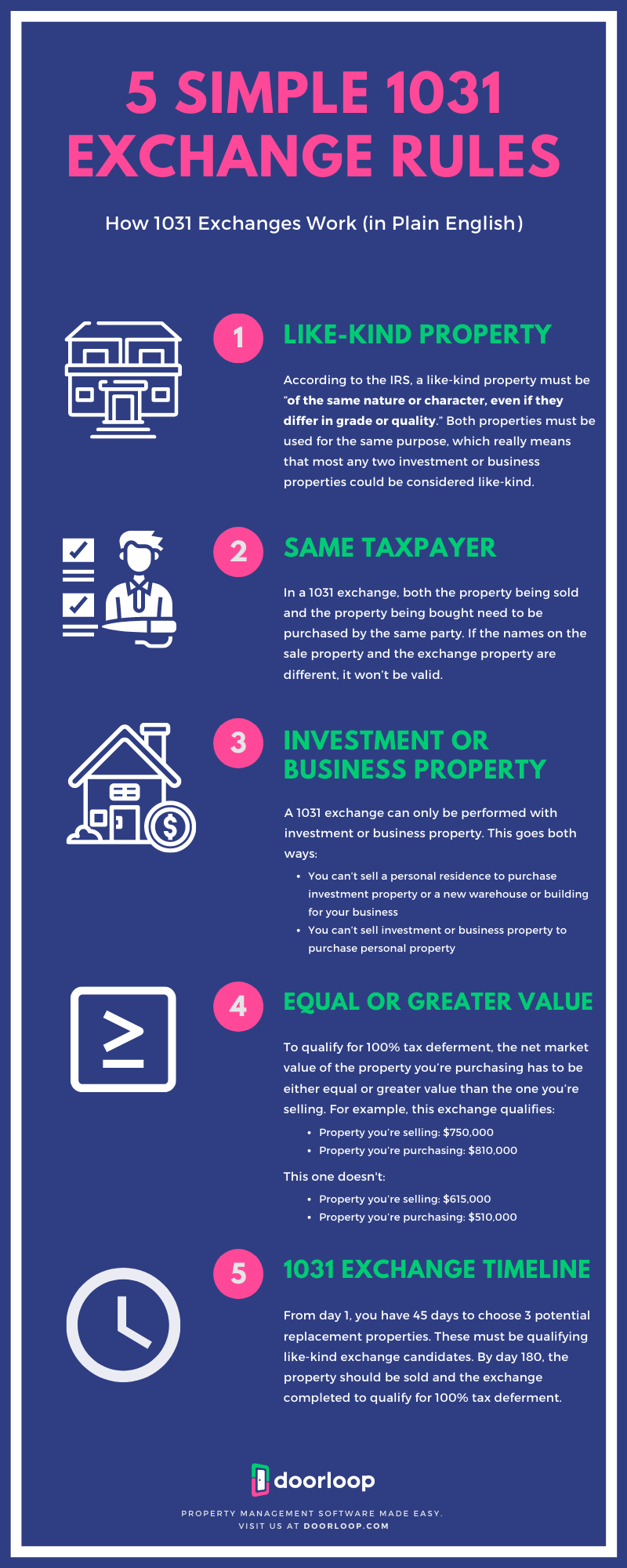

IRC Section 1031 provides an exception and allows you to postpone paying tax on the gain if you reinvest the proceeds in similar property as part of a qualifying like-kind exchange. This property exchange takes its name from Section 1031 of the Internal Revenue Code. There are of course very specific requirements that you must follow so that the sale of your relinquished.

If you would like to find out about the reverse exchange process or the tax deferred exchange process contact one of our experts today. Ultimately the 1031 exchange is a completely legal tax-deferred strategy that any taxpayer in the United States can use. Handling earnest money deposits in a 1031 Exchange.

A section of the US. Those taxes could run as high as 15 to 30 when state and federal taxes are combined. Gain deferred in a like-kind exchange under IRC Section 1031 is tax-deferred but it is not tax-free.

Ad With Decades Of Experience Let Cornerstone Help With Securitized 1031 Replacement Today. 1031 Tax-Deferred Exchange Timeline To qualify as a 1031 exchange you must normally identify the replacement property within 45 days of the sale of the relinquished property and complete your new. Internal Revenue Service Code that allows investors to defer capital gains taxes on any exchange of like-kind properties for business or investment purposes.

A tax deferred exchange that allows for the disposal of an asset and the acquisition of another similar asset without. When selling real estate sellers can face significant tax obligations from the profit of the property sold. Cornerstone Combines The Power Of 1031 Securitized Real Estate.

The tax deferred exchange as defined in 1031 of the Internal Revenue Code offers taxpayers one of the last great opportunities to build wealth and save taxes. The company also offers strategic advisory asset management tax-deferred exchange and capital markets solutions. In a tax-deferred exchange under Internal Revenue Code Section 1031 the sellertaxpayer is prohibited from receiving the proceeds from the sale of the relinquished property.

The following 1033 tax-deferred exchange frequently asked questions FAQs. Of capital gains tax. We want to help your 1031 exchange transaction go as smoothly as possible.

You must also identify your replacement property and complete the exchange within a specific time frame. This post was co-authored with John Starling Senior Vice President Northern 1031 Exchange LLC. In a 1031 exchange the seller of appreciated property may exchange appreciated.

Tax-deferred exchanges cannot be used for personal-use properties and under new laws enacted in December 2017 only real property qualifies for a 1031 exchange. Adjective not taxed until sometime in the future. A 1031 exchange is a tax break.

Taxes on the increased value of the transferred downleg property will be deferred up to the value of the received upleg property. Generally have to pay tax on the gain at the time of sale. You can sell a property held for business or investment purposes and swap it for a new one that you purchase for the same purpose allowing you to.

Is determined by expansive definition of like-kind similar to that of Section 1031. What if the upleg property is purchased for less than sales price of the downleg property. Over the long term consistent and proper use of this strategy can pay.

Delayed Exchange 1031 Tax Deferred Exchange Ipx1031

1031 Exchange Explained What Is A 1031 Exchange

Are You Eligible For A 1031 Exchange

1031 Tax Deferred Exchange Explained Ligris

1031 Exchange Explained What Is A 1031 Exchange

What Is A 1031 Exchange Dst How Does It Work And What Are The Rules

What Is A 1031 Exchange Properties Paradise Blog

What Is A 1031 Exchange Asset Preservation Inc

Irs 1031 Exchange Rules For 2022 Everything You Need To Know

Are Tax Deferred Exchanges Of Real Estate Approved By The Irs Accruit

Hawaii Real Estate 1031 Exchange Buyers And Sellers Information

What Is A 1031 Exchange Commercial Real Estate Md Va Dc

Irs 1031 Exchange Rules For 2022 Everything You Need To Know

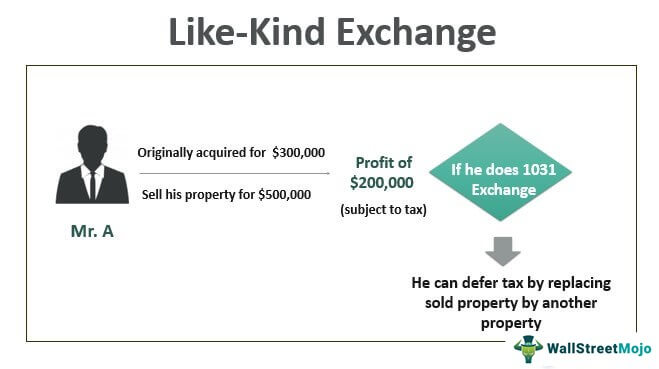

Like Kind Exchange Meaning Rules How Does 1031 Works

All About 1031 Tax Deferred Exchanges Real Estate Investment Tips Youtube

1031 Exchange When Selling A Business

What Is A 1031 Exchange Mark D Mchale Associates

1031 Exchange What Is It And How Does It Work Plum Lending

Irs 1031 Exchange Rules For 2022 Everything You Need To Know